How Modern Debt Collection Agencies Grow Through Experience, Culture, and Reputation

By Adam Parks

Debt collection agencies face growing pressure to not only perform well, but to be seen performing well. With increased public scrutiny, evolving consumer expectations, and a competitive labor market, agencies must reframe how they operate across three key dimensions: consumer experience, brand identity, and digital reputation.

Investing in these areas is no longer optional. Agencies that adapt are collecting more, hiring smarter, and protecting their reputations before challenges arise.

Improved Consumer Experience Drives More Payments

Consumers expect convenience. They manage banking, shopping, and communication from their phones, and they increasingly expect debt resolution to be just as seamless. According to CXM Today, 81% of consumers want more self-service options from the businesses they interact with. That expectation applies to collections as well.

Agencies that offer digital portals, responsive websites, and mobile-friendly payment tools are seeing better engagement. Self-service functionality combined with clear, accessible design improves completion rates by reducing friction in the payment process. In fact, Firstsource reports that 92% of consumers use self-service payment tools when they’re available.

Experience also impacts trust. A well-designed site that mirrors best practices from eCommerce—clear navigation, secure checkout, and intuitive user flow—helps consumers feel more confident about resolving debts. Agencies that lead with professionalism and respect in every digital interaction see better payment performance and fewer disputes.

Better Branding & Aligned Values to Attract & Retain Talent

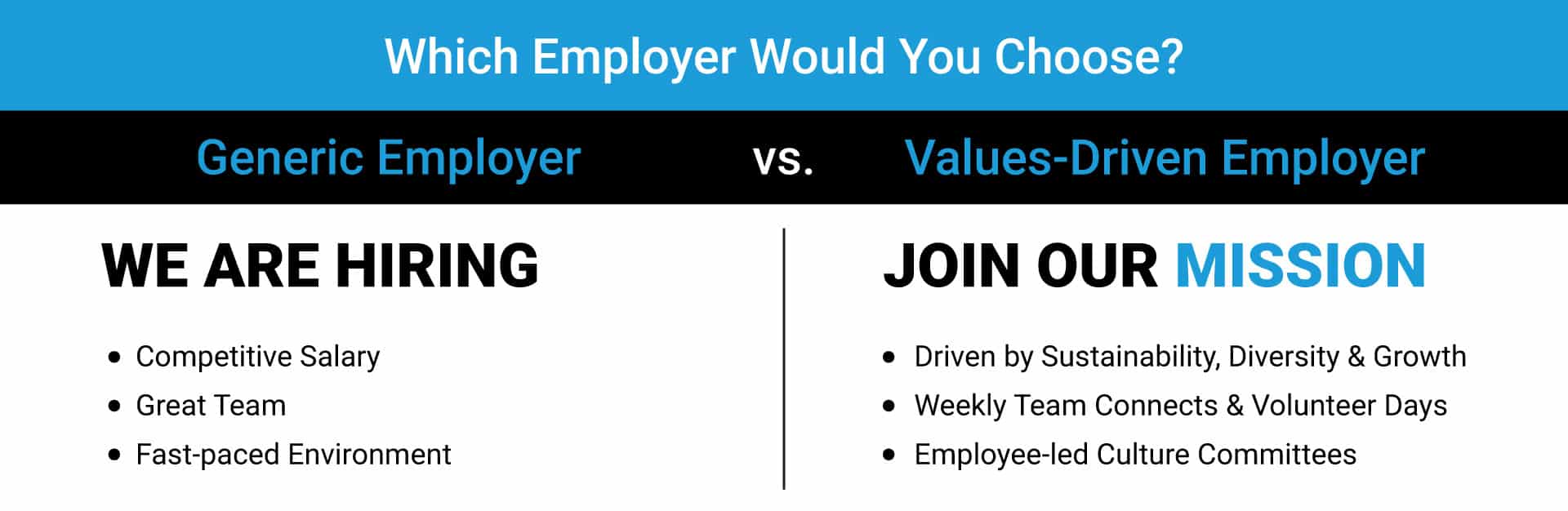

Today’s workforce wants more than a paycheck. Candidates are evaluating company values, culture, and reputation just as carefully as compensation packages. According to a report from VouchFor, 88% of job seekers say an employer’s brand influences whether they’ll apply for a role.

Agencies that clearly communicate their mission, community involvement, and team culture attract candidates who are aligned with their values. This reduces turnover and builds a stronger, more connected workforce. Consistency between internal culture and external messaging is critical—what you promote online should reflect the experience of working at your agency.

LinkedIn, websites, and industry publications provide opportunities to showcase leadership, celebrate employee milestones, and communicate purpose. Organizations with a well-maintained employer brand are 84% more likely to attract quality talent, according to DSMN8.

In a competitive market, a strong employer brand can make the difference between securing top-tier applicants and struggling to fill roles. When employees feel proud of where they work, they’re more likely to advocate for the company and help shape a positive reputation that extends beyond recruiting.

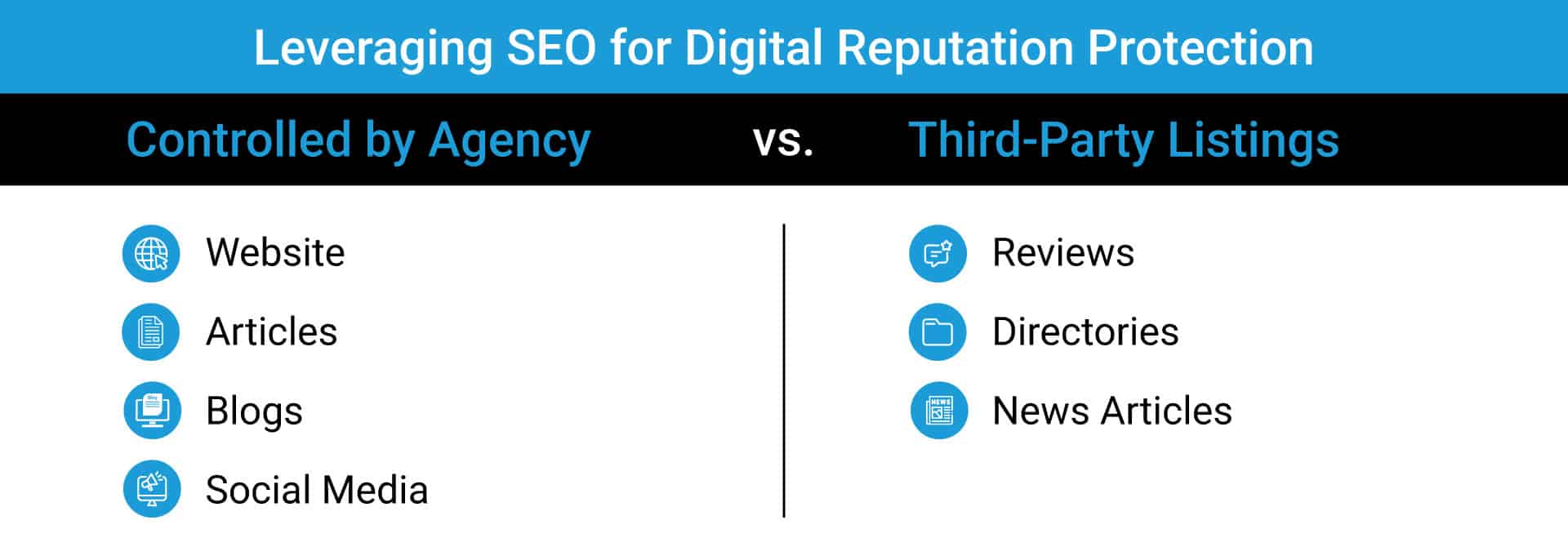

Leveraging SEO for Digital Reputation Protection

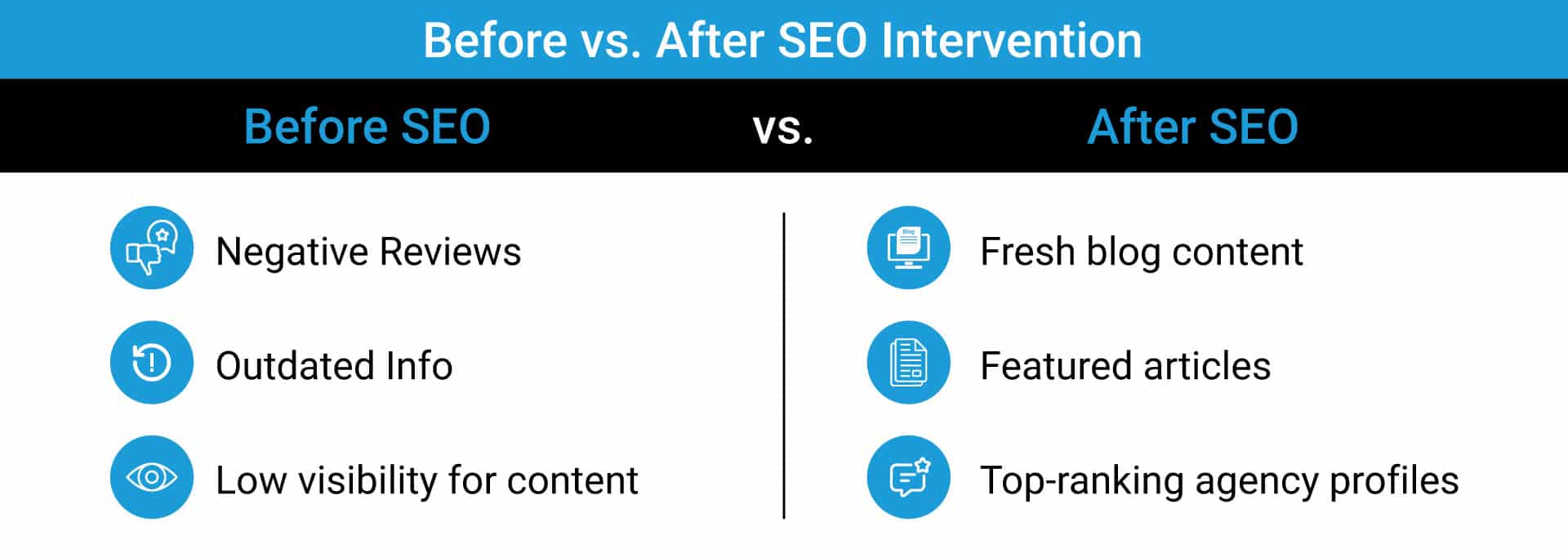

An agency’s online reputation is often formed before any direct contact. In an era of instant search results, what shows up when someone Googles your business defines your credibility. A solid search engine optimization (SEO) strategy helps agencies present the right narrative and reduce the impact of negative or outdated content.

Online reviews play a major role in trust. A staggering 98% of consumers read online reviews before interacting with a business, and 94% say negative reviews have caused them to avoid a company altogether. For collection agencies, even a small number of negative mentions can overshadow years of quality service if not counterbalanced by fresh, relevant content.

Search engine rankings favor recency and authority. Agencies that publish helpful content—through blogs, case studies, community stories, or industry commentary—improve their visibility and ensure that positive content ranks higher in search results. ReputationX reports that 63% of consumers trust online search engines most when researching a business. That means SEO isn’t just about traffic—it’s about trust.

Ongoing content creation, optimized page structures, and participation in industry platforms create a resilient digital presence. When you own the narrative across branded search results, you gain greater control over first impressions with consumers, clients, and potential hires.

Don’t Just Rely on Operations

High-performing debt collection agencies don’t succeed by focusing only on operations. They invest in consumer experience to drive payments, shape their employer brand to attract talent, and build digital reputations that protect long-term trust. Each of these areas supports the others, creating a holistic foundation for sustainable growth.

Strong branding is no longer optional. It is a strategic asset that helps collection agencies stand out, stay relevant, and succeed in a reputation-first environment.

About The Author

Adam Parks has become a voice for the accounts receivables industry. With almost 20 years working in debt portfolio purchasing, debt sales, consulting, and technology systems, Adam now produces industry news hosting hundreds of Receivables Podcasts and manages branding, websites, and marketing for over 100 companies within the industry.