Protecting Consumer Data in Debt Collection with the Right Online Tools

For a debt collector, securing consumers’ personal information is non-negotiable. Now imagine unintentionally broadcasting a consumer’s financial information on a public billboard. As unlikely as it may seem, this is what can happen if sensitive account activity is handled through a basic WordPress website.

Organizations that manage sensitive financial data know that this distinction isn’t just technical—it’s strategic. Not all digital platforms are built for the same purpose, and in the debt collection industry, understanding that difference is critical.

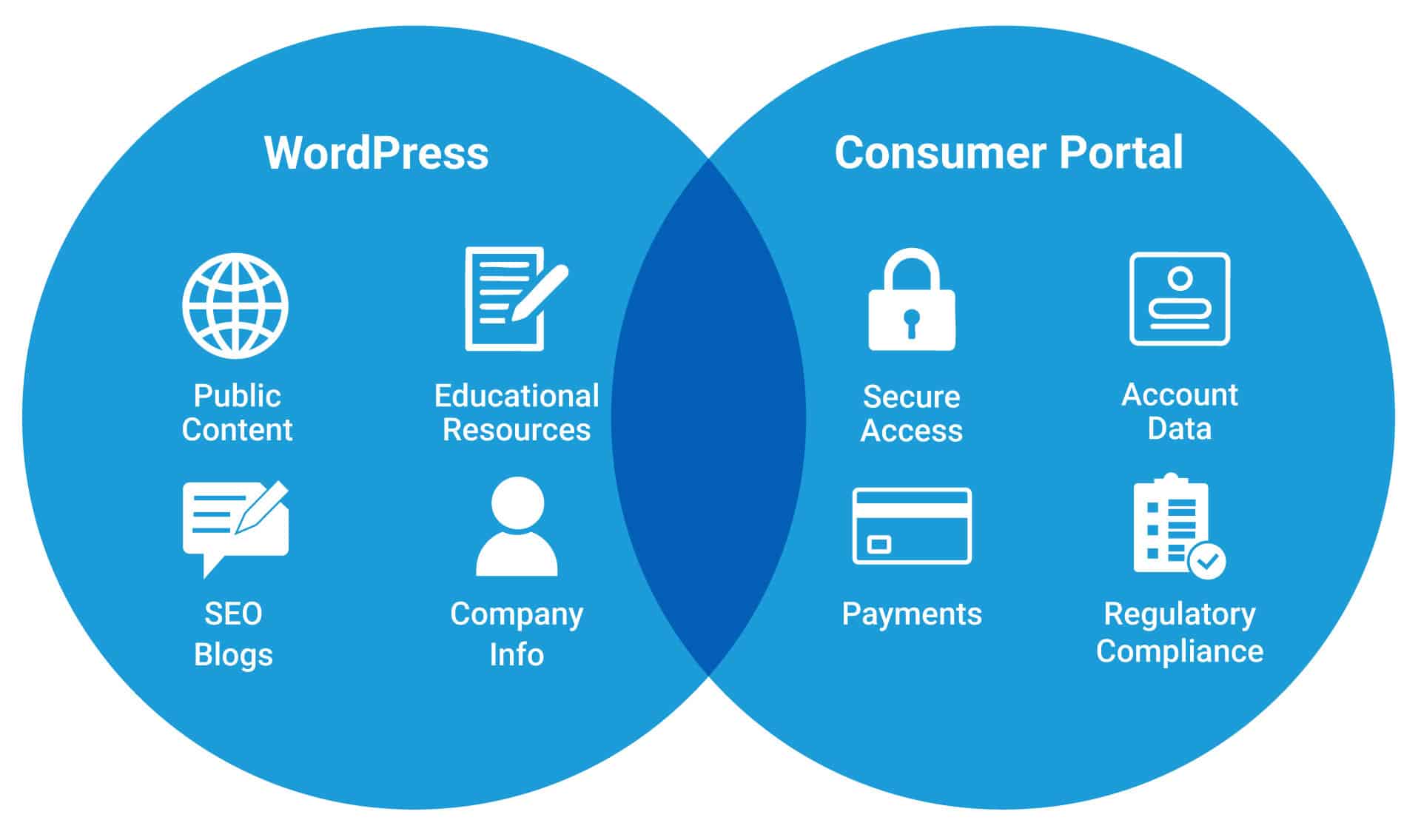

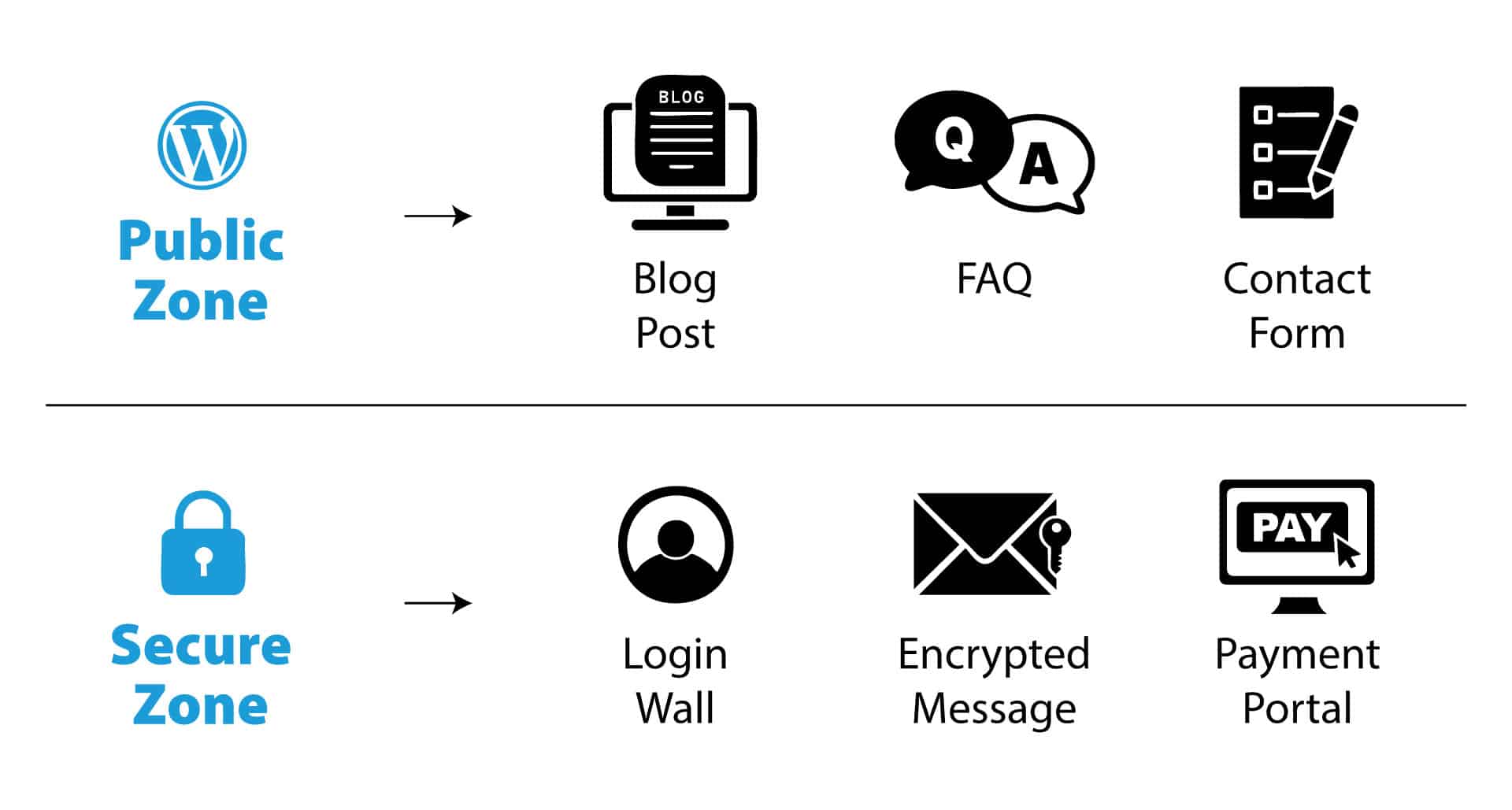

While WordPress sites are valuable for public-facing content, a consumer portal, by contrast, provides the secure, access-controlled environment necessary for handling private account data, facilitating payments, and maintaining regulatory compliance.

When used appropriately and in cohesion, they form a strong, compliant digital strategy. When misused or confused, they can expose an agency to data breaches, regulatory violations, legal risks, and a loss of consumer trust.

This article explores how these tools work, how they differ, and why it’s essential to use each in the right context.

When to Use WordPress

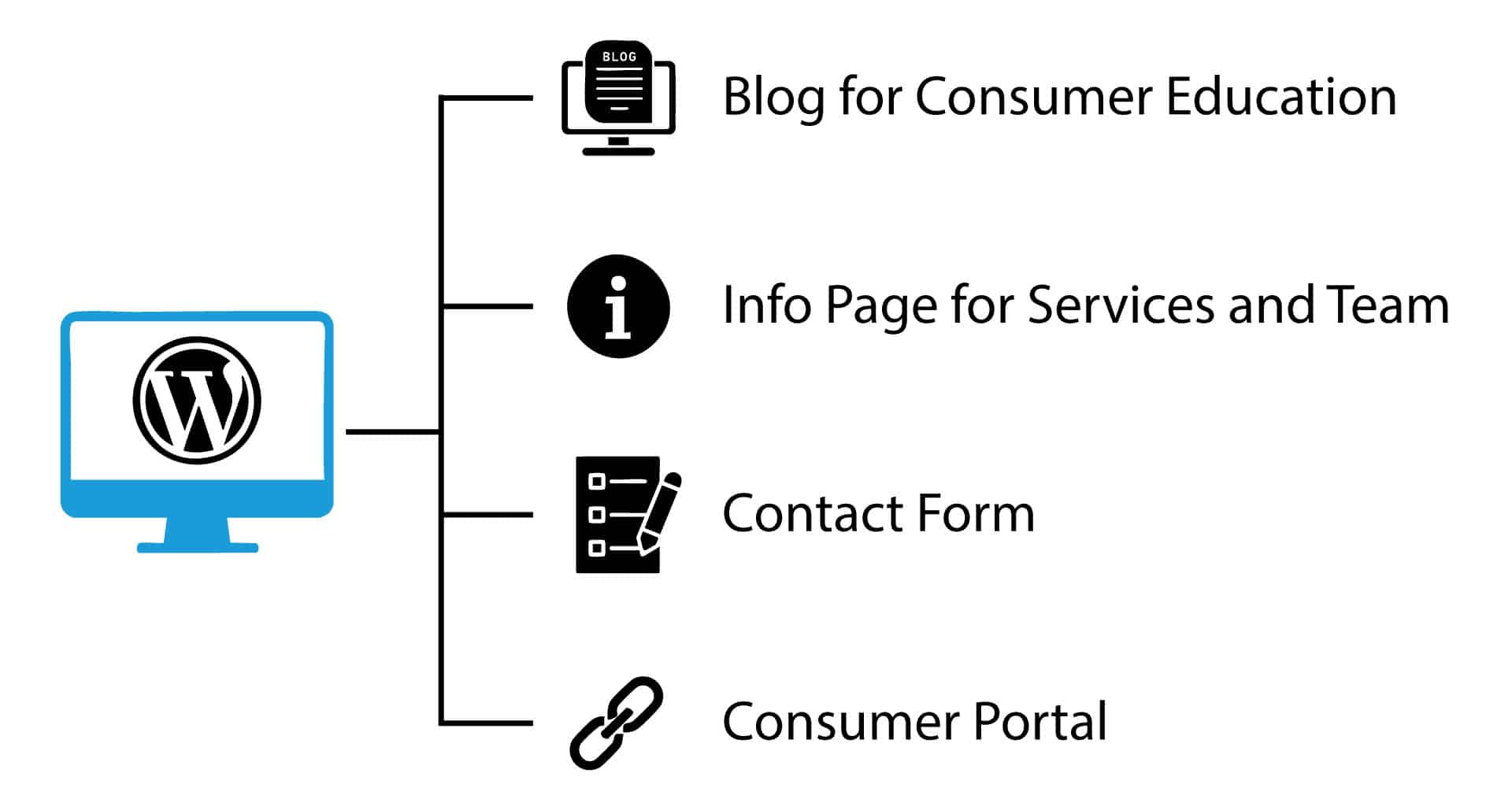

For debt collection agencies looking to establish a strong digital presence, WordPress offers a reliable and flexible foundation. It is a tool for shaping how an agency is perceived by consumers, clients, and regulators.

At its core, WordPress is best suited for information that anyone can access without logging in or verifying their identity. This includes details about an agency’s services, approach to compliance, and general educational resources about managing debt.

One of WordPress’s biggest strengths lies in its ability to support content-driven engagement. If an agency produces blog posts that explain the debt collection process, offer financial literacy tips, or help consumers understand their rights, the platform provides tools to publish and optimize that content for search engines.

It’s also a great place to share updates about a new compliance certification, a community outreach initiative, or internal milestones. Though seemingly minor, these educational elements help build trust and reinforce an agency’s credibility over time.

In many ways, the platform functions as a digital storefront—open to the public and designed to make a good first impression.

Where WordPress really finds its limits, though, is in how it handles sensitive information. While it’s perfectly fine to use the platform for basic contact forms or general inquiries, it’s not built to manage account-specific data, host secure messaging, or process payments.

This platform can support the conversation, but it cannot be the place where that conversation turns personal. This is where secure consumer portals come into play.

When to Use Consumer Portals

Consumer portals are built for secure, regulated, and personalized interactions. They function as the digital operations floor where consumers can manage their accounts, make payments, and communicate with an agency’s team in a protected environment.

These portals are designed for transactional tasks that require authentication, security, and compliance.

From a debt collector’s perspective, consumer portals deliver essential functionality that enhances both the consumer experience and agency operations. They allow consumers to securely log in and access real-time account information without needing to call or email. Integrated with PCI-compliant payment gateways, portals also enable self-service payments, reducing the need for manual processing and improving convenience for the consumer.

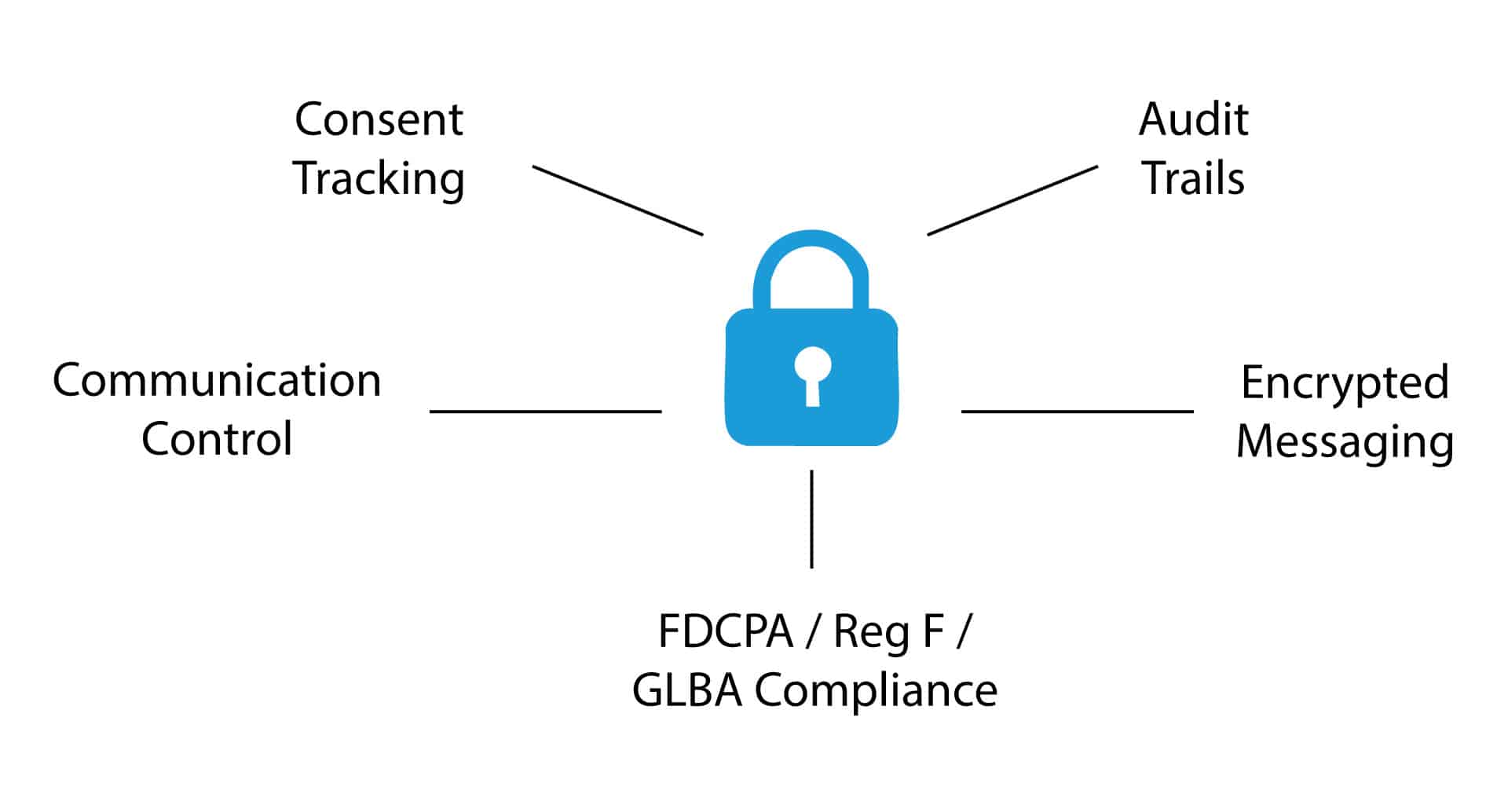

Beyond functionality, compliance is where they truly stand apart. Consumer portals help meet regulations like the FDCPA, Regulation F, GLBA, and various state laws by offering encrypted messaging in place of unsecure emails or generic contact forms. Built-in features like consent tracking, audit trails, and communication controls ensure that an agency’s team can interact with confidence, knowing that all interactions are defensible and documented.

These compliance benefits have a direct impact on day-to-day operations. When properly implemented, portals ease the burden on agents by filtering out routine tasks, improving resolution rates, and reducing legal exposure.

They support a more modern, omnichannel approach that feels responsive and safe, lowering the cost and friction of doing business. Fewer voicemails, less printed mail, and shorter phone queues mean the team can focus on helping people resolve their debt in a way that feels secure and straightforward.

What Can Happen When the Line Gets Blurred?

Failing to draw a clear boundary between the public-facing website and the secure consumer portal can expose an agency to a wide range of serious risks that were preventable in the first place.

Chief among them is data security. WordPress, while popular, is also a top target for cyberattacks due to it being an open source platform and its reliance on third-party plugins and themes. Using it to handle consumers’ personally identifiable information (PII) significantly increases the risk of data breaches.

And when security fails, the consequences go far beyond technical headaches. Mishandling personal data—even unintentionally—can trigger a cascade of legal, financial, and reputational fallout. Lawsuits, regulatory fines, and consumer distrust often follow. When people lose confidence in the legitimacy or safety of an agency’s digital experience, they disengage, complain, or take their concerns to regulators.

This is precisely why it’s so important to clearly define the roles of digital tools. Drawing a firm line between what belongs on a WordPress website and what should be handled within a secure consumer portal is the digital boundary that protects a debt collection agency from unnecessary legal risk.

About the Author

Adam Parks has become a voice for the accounts receivables industry. With almost 20 years working in debt portfolio purchasing, debt sales, consulting, and technology systems, Adam now produces industry news hosting hundreds of Receivables Podcasts and manages branding, websites, and marketing for over 100 companies within the industry.