Why Debt Collection Agencies Must Stay Active on Social Media

The debt collection industry is no stranger to public scrutiny, and in a space where perceptions can impact partnerships, performance, and compliance, controlling your own narrative is more important than ever.

For years, collection agencies avoided social media out of caution, but that strategy no longer works in 2025. In today’s digital environment, a lack of visibility is almost as damaging as negative visibility.

Whether it’s LinkedIn, YouTube, or even Instagram, active and strategic social media management is no longer optional. It’s a vital business function that supports marketing, sales, SEO, client relations, and long-term brand trust.

Increased Brand Awareness and Reputation Control

Debt collection companies are highly visible, whether they choose to participate online or not. If your agency is silent on social media, the only content people will find about you may come from collection review sites, third-party forums, or outdated press.

Social platforms like LinkedIn, Facebook, and YouTube give you a way to consistently publish content that tells your story, highlights your team, and demonstrates your values.

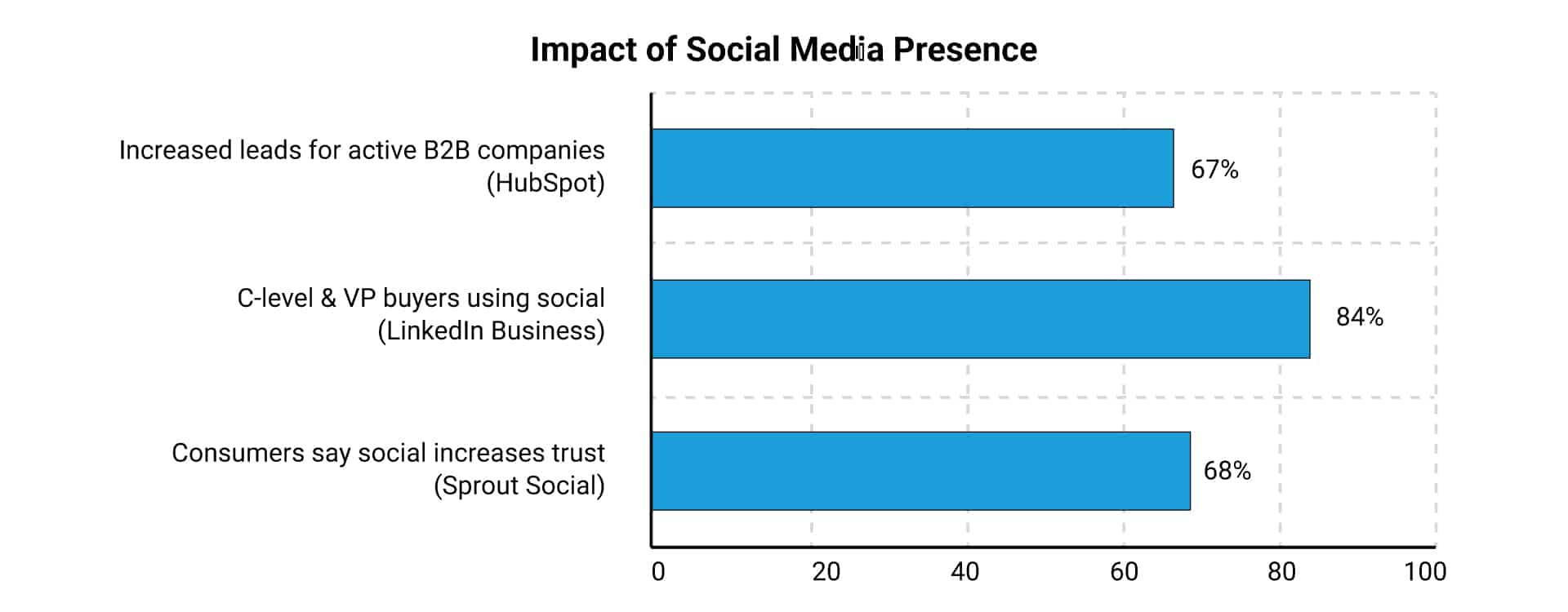

According to the 2024 Sprout Social Index, 68% of consumers say that a brand’s presence on social media increases their perception of trustworthiness. When agencies share charitable efforts, team wins, certifications, and leadership participation in trade associations, it shifts the narrative from one-dimensional to multi-faceted—and human.

Enhanced SEO Rankings and Online Visibility

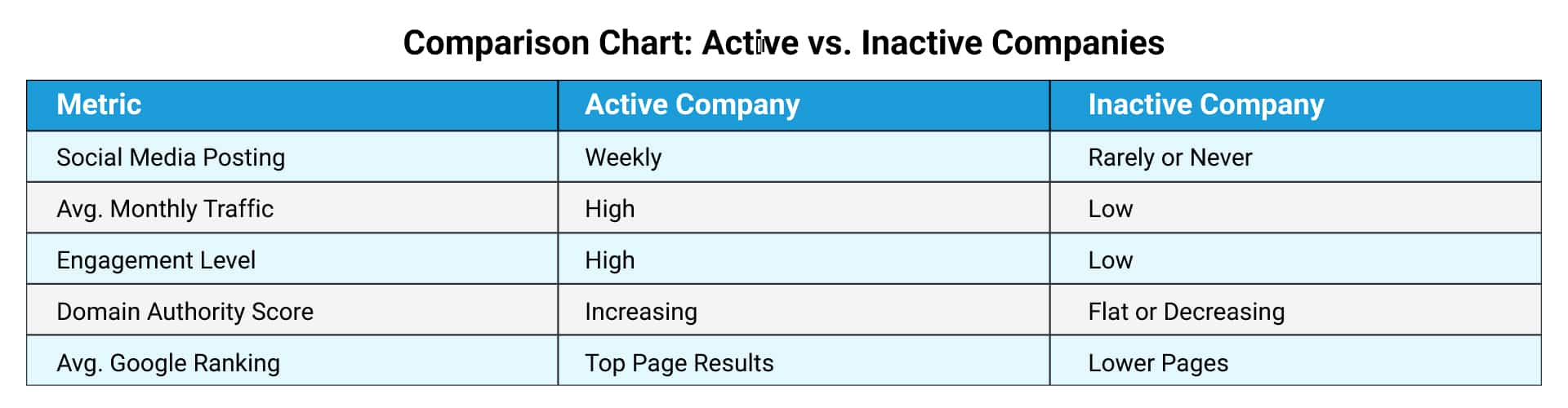

A strong social media presence directly contributes to better search engine optimization (SEO). Each time your company posts, shares, or is mentioned on LinkedIn or other platforms, that content is indexed by search engines. This activity helps push fresh, relevant content to the top of Google search results, while pushing down negative or outdated mentions.

Consider the most trustworthy collection company you know. The most likely top searches come from either their own social media engagement, or trade associations interacting with their content. This SEO value is vital for ensuring malicious sites are pushed further down in the rankings.

Google’s algorithm considers brand signals and trustworthiness in its rankings, and consistent activity across platforms can boost your domain authority over time.

For debt buyers, creditors, and consumers Googling your company name, this can mean the difference between a lost opportunity and a new relationship.

Improved Client and Consumer Engagement

While many assume social media is only for consumers, the reality is that clients and industry peers are just as present online. LinkedIn alone has over 1 billion members as of 2024, with the vast majority of professionals in finance, banking, and compliance actively using the platform.

An up-to-date company page that shares news, articles, conference attendance, and leadership milestones helps agencies stay top-of-mind with current clients while making a favorable impression on potential new ones. Regular engagement also shows your agency is responsive, transparent, and modern, which are qualities that matter in competitive Request for Proposal (RFP) processes.

Establishing Thought Leadership and Industry Credibility

Thought leadership is a long-term play, but one with a high return. Publishing articles, videos, or commentary on current events in receivables shows that your agency understands the big picture. It positions your leaders as experts, not just vendors, and builds trust among partners, peers, and regulators alike.

Involvement in organizations like RMAI, ACA International, or local business chambers becomes exponentially more impactful when amplified on social media. Your content doesn’t need to go viral to be valuable. Consistency is what builds influence.

Lead Generation and Sales Impact

Thought leadership doesn’t just boost brand credibility—it generates real business. According to the 2022 LinkedIn-Edelman Thought Leadership Impact Study, 61% of decision-makers say thought leadership is more effective at building trust than traditional product marketing.

For debt collection agencies, that means publishing original content, sharing industry news, and offering insights into regulatory or compliance topics can directly lead to conversations with prospective clients.

Social selling strategies on LinkedIn, when used thoughtfully, also help sales teams connect with decision-makers and expand reach organically. Agencies that prioritize social media are increasingly viewed as credible, progressive partners rather than anonymous vendors.

Data-Driven Strategy and Industry Trendspotting

Posting on social media is only half the equation. Listening and engaging on social media is the other half of the coin.

Platforms like LinkedIn and YouTube are rich with real-time insights from across the receivables and financial services industries. By following competitors, trade groups, compliance leaders, and fintech influencers, your team can gain valuable information about market shifts, pain points, and innovations.

Social analytics also offer direct insight into what content resonates with your audience. That data can inform future marketing campaigns, guide content creation, and even influence service offerings or product development.

Competitor Monitoring and Strategic Advantage

Your competitors are online. If they’re not, that’s an opportunity. Monitoring what others are sharing can help you benchmark your own progress and identify gaps in market coverage. Are your peers publishing compliance content? Promoting community involvement? Hosting webinars?

Keeping an eye on industry trends through social media allows your team to stay agile and informed. It also ensures that your agency remains relevant in conversations that matter to both clients and regulators.

You Really Can’t Afford Not To

Debt collection companies can no longer afford to sit out the social media conversation. Whether you’re focused on brand protection, lead generation, or building trust with clients and consumers, your digital presence plays a direct role in your agency’s success.

Social media isn’t just a marketing channel. It’s now a visibility tool, a relationship builder, a reputational safeguard, and a business intelligence source. In a highly scrutinized industry, staying active, authentic, and strategic online helps you take control of your story and lead with purpose.

About the Author: Katalina Dawson

Katalina Dawson is the Executive Vice President at Branding Arc, where she leads the development of creative marketing strategies tailored to the receivables industry. With a background in event management and copywriting, she brings a dynamic, results-driven approach to client engagement and brand storytelling.

Katalina is actively involved in industry organizations, currently serving as a Board Member and Chair of the Website and Marketing Committee for Women of Debt Relief (WoDR) and as a member of the Editorial Committee at Receivables Management Association International (RMAI). Her work in these roles supports thought leadership, professional engagement, and the digital growth of the receivables community.